How is Slide Insurance Different from Citizens?

Many Floridians get their coverage from private carriers like Slide. As a private insurer, Slide offers insurance products that are approved by Florida state insurance regulators.

Citizens Insurance, Florida's state-run insurance program, offers homeowners policies when there are no available private insurer options. This not-for-profit carrier is meant to be the "insurer of last resort," and their policies typically have fewer coverage options and lower coverage amounts than private insurers offer.

Over the past few years, most private insurers offering coverage in Florida have gone out of business or left the state. The lack of private insurer options has led to a rapid increase of policyholders in the government program, which was never meant to take on this much risk.

This leaves the Florida government, Citizens' policyholders, and the Citizens' program susceptible to major financial impacts if a major storm hits the state.

Fortunately, new insurers like Slide have entered the market, providing options that are more comprehensive and personalized for the unique needs of Florida homeowners.

Here are a few things you should know if you are comparing Slide's coverage to Citizens.

Why Citizens Premiums May Be Cheaper Than Slide

In some cases, the initial cost of Citizens insurance may be less than Slide’s. One explanation for this is that all insurers use different formulas to calculate their homeowners policy premiums. It all comes down to risk. In the event of a covered loss, each insurer must be capable of paying the claim. The premium charged needs to reflect the amount of risk the insurer is taking on.

Since Citizens is a state-run company, different factors are considered in their premiums.

For example, Citizens does not need to fully buy reinsurance (insurance for insurance companies) to help them pay policyholders’ claims after a major catastrophe. For a private insurer, reinsurance is their largest expense. Instead, the Florida state government gives Citizens the power to charge policyholder assessments (sometimes called a “hurricane tax”) to rebuild its financial reserves. Citizens policyholders can be assessed up to 45% of their premium.

Another important difference is state laws limit what Citizens can charge and how much it can increase their premiums year to year. This has kept Citizens’ rates low; however, there are many concerns that this creates a serious risk of there not being enough funds from premiums to pay claims after a major named storm or a series of smaller storms. Recent legislation has been put in place to bring Citizens’ rates more in line with what is needed for the risks they incur.

The initial premium is only one factor you should consider when comparing insurers. Let’s look at some others.

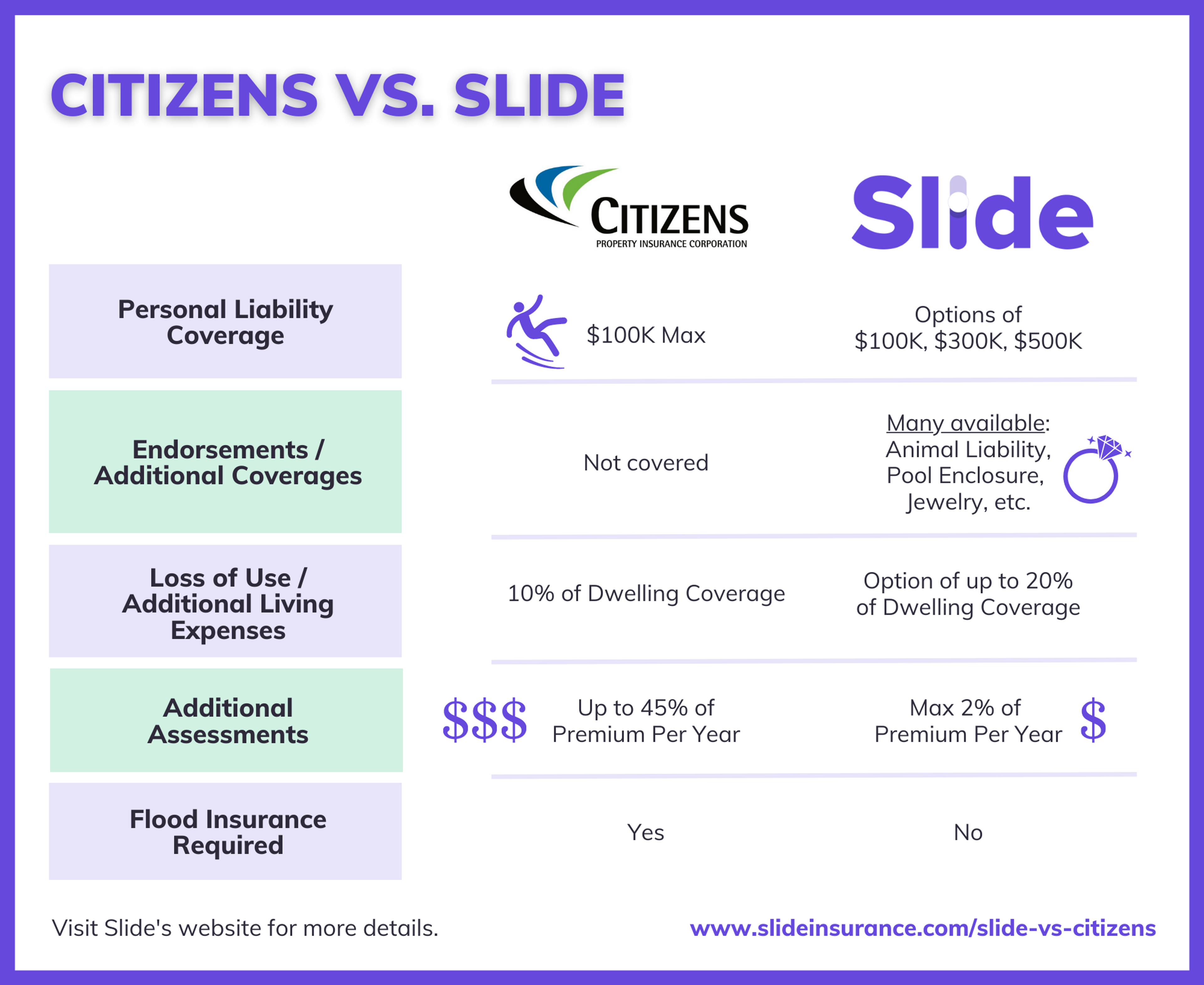

Slide Insurance vs Citizens’ Property Insurance at a Glance

Personal Liability Coverage Limits

Personal Liability coverage is an important way of protecting yourself if you're held liable for someone else's injuries on your property - or cause damage to someone else's property.

- Citizens policies are limited to $100,000 for personal liability coverage.

- Slide offers coverage options of $100,000, $300,000, or $500,000.

As a rule, it's best to select a coverage limit that matches or exceeds your net worth. For example, if your total net worth is $250,000, you should consider opting for $300,000 in coverage to fully protect your assets, especially from claims settled in court.

Optional Coverages Available with Slide

Additional coverage options (also called endorsements) give you greater control to customize your insurance to the risks unique to your property.

- Citizens policies cover only what's listed in their standard homeowners policy. There are no available optional coverages.

- Slide offers endorsements to increase or add coverage in several categories, including damage to screened pool enclosures, water/sewer backup, loss or theft of high-value items, and animal liability.

Optional coverages are a great way to customize your policy and reduce the potential for unexpected out-of-pocket expenses for losses not covered in your policy.

The choices you make are a critical part of your financial planning. Your insurance agent is a great resource to help you dive deeper into the full list of optional coverages and policy terms.

Loss of Use and Additional Living Expenses

For families displaced by a catastrophe, Loss of Use/Additional Living Expenses (ALE) coverage reimburses many costs associated with being away from home.

- Citizens' standard homeowners policy reimburses ALE up to 10% of total dwelling coverage.

- Slide's homeowners policy offers optional ALE up to 20% of total dwelling coverage.

Repairing a house damaged by a fire, tornado, or hurricane can take weeks or even months. Costs can quickly add up if your household is required to relocate for an extended period.

Additional Assessments

After past disasters, Citizens has paid out more in claims than it had collected in premiums. When this happens, Citizens policyholders pay an assessment called the Citizens Policyholders Surcharge to rebuild the state insurer’s financial reserves.

- Citizens policyholders pay this surcharge first, up to 45% of their annual premium.

- Any remaining shortfall can be assessed to private policyholders at up to 2% of their annual premium as part of Citizens’ Regular Assessment.

Florida weather is unpredictable. When storms cause a deficit in Citizens’ funds, the Citizens’ policyholders bear the majority of the burden in rebuilding the fund to ensure the claims can be paid.

While Citizens’ premiums are lower up front, policyholders must plan for the potential of having to pay the assessment. Visit the Citizens site for an assessment calculator.

Flood Policy Mandate

When comparing Citizens and Slide, you also need to consider the additional cost of flood insurance.

- As of July 2023, all new and existing Citizens policyholders living in areas designated as Special Flood Hazard Areas by the Federal Emergency Management Agency (FEMA) are required to purchase separate flood insurance. All Citizens policyholders will be required to have flood insurance by January 2027.

- Slide insurance does not have a flood insurance requirement.

Standard homeowners policies don't cover flooding. Slide doesn't have a flood insurance mandate, which means our customers have the choice to purchase this coverage separately if it's right for their needs and budget.

When It Comes to Homeowners Insurance, the Difference is Clear

Citizens is a great program for those who do not have a private insurer option, but it is designed to be a true last resort.

When choosing the right insurance for your unique needs, it is important to review the coverages closely. You should look not only at the upfront costs, but at the potential financial impact should you endure a loss.

Independent agents serve as experts on the terms of insurance coverages and are an excellent resource to help you craft the right policy for the risks of your property and your financial situation.

We look forward to showing you the Slide difference. Contact your agent to discuss your options today.