Understanding Your Hurricane Deductible

Your Slide homeowners insurance policy covers everyday occurrences like fire, theft, and liability. It also provides coverage for hurricane-related damage.

There are two separate deductibles on your policy—a standard homeowners deductible (called “All Other Perils”) and a hurricane deductible.

We’ve created this short guide to help you understand hurricane deductibles and be sure the deductible amount you choose is right for your situation.

What is a hurricane deductible, and when does it apply?

In simple terms, “deductible” is the amount you are responsible for paying out-of-pocket toward a covered loss before your insurance kicks in.

The same basic rule applies to a hurricane deductible, which is specific to windstorm damage from a hurricane.

Florida law dictates when hurricane deductibles apply:

“Beginning at the time a hurricane warning is issued for any part of Florida by the National Hurricane Center of the National Weather Service and ending 72 hours following the termination of the last hurricane watch or hurricane warning issued for any part of Florida by the National Hurricane Center.”

The standard hurricane deductible for Florida homeowners insurance policies is 2% of your dwelling coverage amount (also called your Coverage A). You can customize your deductible to 1%, 5%, or 10% based on your financial situation.

Having a higher deductible will reduce the amount you pay upfront in premiums, but you will pay more out-of-pocket if you have a loss.

One important thing to note: your homeowners insurance does not cover damage due to flooding or storm surge damage caused by a hurricane. Claims for flood damage would be subject to the terms of a separate flood insurance policy you would purchase from your insurance agent.

How does a hurricane deductible affect my claim reimbursement?

When you file a claim for damage caused by a hurricane, your hurricane deductible is subtracted from any amount you are reimbursed in your claim settlement.

Here’s an example of how this would work for a home with $410,000 dwelling coverage (Coverage A) and a 2% hurricane deductible.

- Your hurricane deductible would be $8,200 ($410,000 x 2%)

- If you had $50,000 of covered hurricane damage, you would be responsible for $8,200; Slide would reimburse you the remaining $41,800.

$50,000 damage - $8,200 out-of-pocket deductible = $41,800 claim reimbursement.

This example uses replacement cost calculations. Your specific policy terms and conditions would apply.

When selecting deductible amounts for your insurance policy, your financial situation should be top of mind. A best practice for financial planning is to have an emergency savings fund that covers your potential out-of-pocket expenses in a worst-case scenario.

Where can you find the amount of your hurricane deductible?

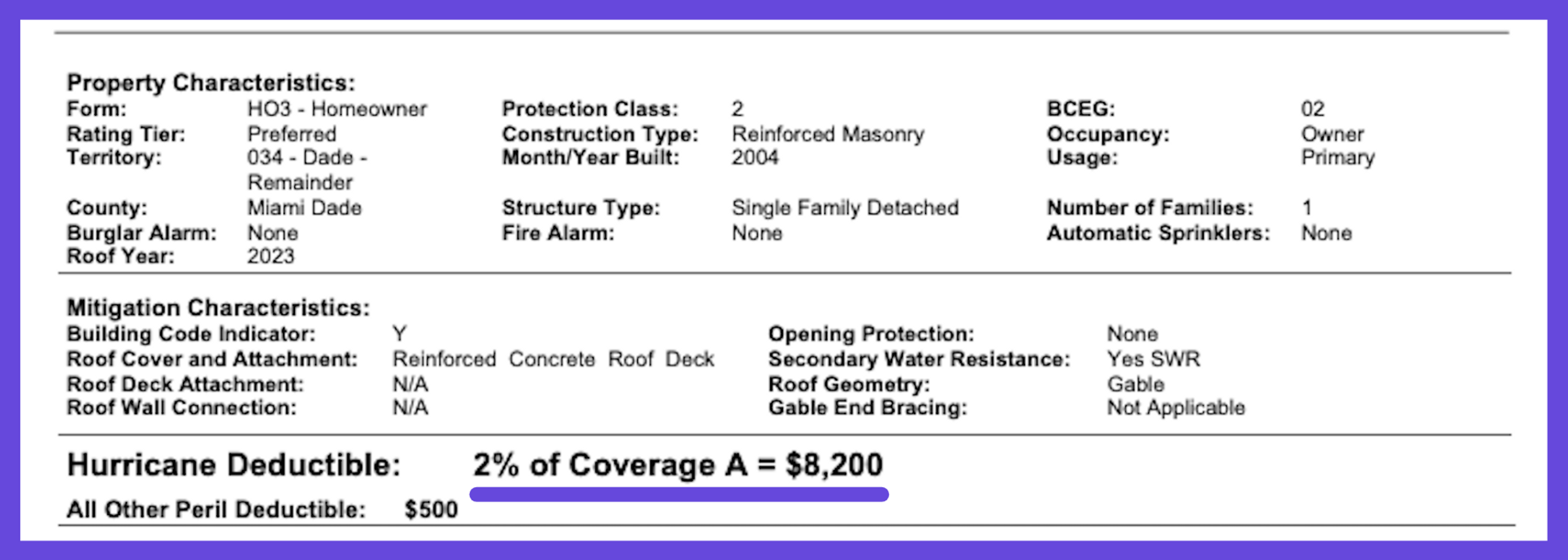

Your deductible amounts can be found in your Slide homeowners insurance document packet, called the “declaration page and policy forms.”

Here, you can see your hurricane deductible listed clearly on the declaration page, which is the first page of your policy.

The figure is presented as both a percentage of your dwelling coverage (listed here as Coverage A), and as a dollar amount, $8,200.

Conclusion

Your homeowners insurance policy has two separate deductibles for everyday losses and hurricane-related losses. Knowing the facts about your hurricane deductible can help you plan for potential out-of-pocket expenses.

When selecting your hurricane deductible, the higher the deductible you choose, the lower your premium. However, a higher deductible also means increased out-of-pocket expenses should you have a loss.

Your Slide agent and financial planner are excellent resources to assist you in planning ahead for emergency situations like hurricanes.

Visit the Slide Storm Center to get more information and resources on planning for hurricanes.